I will not access this website if that registration is withdrawn. Distributed by Timothy Partners, Ltd. Member FINRA.

Defensive Strategies Mutual Fund

Protection of principal through an aggressive, proactive investment strategy

Timothy Plan's Defensive Strategies fund is another fund that is unique to Timothy Plan. As one of the only, if not the only, funds that holds physical gold bullion outside of a Central Bank, it is designed to provide security in times of uncertainty. Investing in real estate, TIPs and cash or cash equivalents, its objective is to provide stability should there be unpredictable market conditions such as high inflation or a rapid increase in interest rates. Call +1 (800) 846-7526 or chat online if you need any assistance.

Objective

The Fund's objective is to provide an investment option that will react to rapidly changing economic conditions.

Strategy

The adviser to the Defensive Strategies Fund intends to manage the allocation of the various sleeves in accordance with varying economic conditions. Currently the Fund's allocation is over-weighted in TIPS and cash while underweighted in REITs and commodity based ETFs. Key elements in guiding the allocation process are market conditions and the level of inflation or deflation. Although the adviser cannot guarantee or accurately predict future events, the adviser's primary goal is preservation of principal.

Is this fund right for you?

- This fund is committed to our comprehensive filtering criteria.

- Low risk.

- Seeking stability and/or a safe-haven for rapidly changing economic conditions, such as inflation or increasing interest rates. · Inflation sensitive fund comprised of TIPS, REITs, cash and cash equivalents.

- Physical gold bullion held outside of a Central Bank.

Risk & Strategy

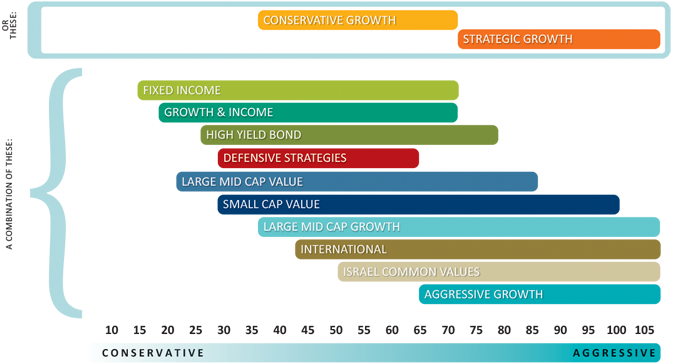

We have created a worksheet to help you decide which funds might meet your investment needs, Asset Allocation Investor Worksheet. Answer the questions, then add your points to consider an appropriate strategy. The scale attempts to create a spectrum of the funds using a broad brush criteria of aggressiveness/risk. The scale and order of funds may not be accurate at any point in time, because as the markets shift and change, so will the relative positions of the funds. This should be considered as a general guideline and not a scientifically created/maintained analytical tool. You may want to consider a more aggressive or more conservative diversification than your score indicates.